Barbie’s brand back? Brand value rises on the back of mega movie success

New data from Brand Finance reveals growth for iconic doll brand amidst Mattel’s challenges

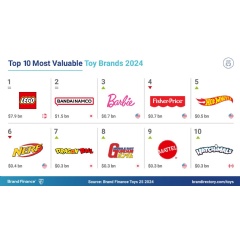

- Barbie rises to number three in toy brand ranking, defying industry slump

- A decade on top: LEGO’s building blocks for brand value

- Japanese toy brands are among the fastest risers in latest ranking

Barbie’s brand value has risen slightly to USD720.8 million, according to new data from Brand Finance, the world’s leading brand valuation consultancy. The iconic doll brand has also seen a slight uptick in its brand strength index (BSI) score to 88/100, now commanding a strong AAA brand strength rating. As such, Barbie moves up one rank overall to take third place in Brand Finance’s latest Toys 25 ranking. This growth comes amidst broader challenges facing toy manufacturer Mattel and the global toy industry, which has seen an overall decline in brand value.

Barbie’s brand saw a resurgence late last year following the release of Greta Gerwig’s megahit Barbie movie, which became the highest-grossing film of 2023 and a cultural phenomenon across the world. The movie’s triumph significantly bolstered Barbie’s global brand recognition, captivating audiences worldwide with its modern twist on the story of the iconic doll.

That said, while the Barbie brand has seen promising growth on the back of the movie, Mattel’s overall sales outlook has been limited. Mattel’s slipping sales have raised doubts as to whether this success will translate into sustained interest in the Barbie brand in the coming years. This downward trend reflects broader economic challenges affecting consumer demand within the toy industry, where declining interest in toys presents additional hurdles for companies like Mattel to navigate.

Richard Haigh, Managing Director, Brand Finance UK, commented:

“The Barbie film undoubtedly garnered significant global attention and contributed to an uptick in engagement with the Barbie brand, especially among young adults who enjoyed the film’s nostalgia. That said, a single cinematic success does not guarantee sustained growth. More brand engagement and popularity does not automatically translate into more Barbie doll purchases. To fuel further growth for the Barbie brand in the coming years, Mattel must find ways to strategically leverage this global brand exposure to maintain consumer interest in its iconic doll line, particularly among the key toy-purchasing demographics.”

LEGO is the world’s most valuable toy brand for the tenth year running, increasing its brand value by 6.5% to USD7.9 billion. Fuelled by a year of solid sales growth, the brand has opened 147 new Lego-branded stores worldwide, bolstered its digital presence, and rolled out innovative new product lines. As one of the world’s most recognisable toy brands, LEGO’s enduring dominance at the top of the rankings also underscores decades of built-up brand equity and enduring nostalgia that continues to resonate with consumers across the globe. As such, it has become the world’s strongest toy brand in 2024, with a BSI score of 88/100.

Japanese toy giant Hello Kitty is the fastest-growing toy brand in 2024, increasing its brand value by 27% to USD208.5 million. The brand continues to enjoy massive exposure and popularity in its home market, which has fuelled strong sales growth in recent years. Behind Hello Kitty, One Piece is the second-fastest-growing toy brand, with its brand value up 18.5% to USD132 million.

About Brand FinanceBrand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Definition of BrandBrand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand StrengthBrand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Valuation ApproachBrand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

DisclaimerBrand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance’s proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.

( Press Release Image: https://photos.webwire.com/prmedia/8/320939/320939-1.jpg )

WebWireID320939

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.