Oil Price Drop Flat Lines Defence Spend, According to New Global Defence Budget Report from IHS

Asia Pacific will drive defence growth in five-year outlook; By 2019, NATO will not account for majority of global defence spend

We expect a decent increase in investment starting in FY16, yet dependent on a potential sequester becoming reality once again

Defence spending is forecast to flat-line globally over the next two years as fiscal constraints among oil producing states in the Middle East and North Africa remove a key source of growth.

The new analysis, released today by IHS Inc. (NYSE: IHS), the leading global source of critical information and insight, features global, regional and country-specific forecasts for defence expenditure, procurement, research and development across 91 countries and captures 98 percent of global defence spend.

Key highlights and forecasts from the IHS Defence Budgets Annual Report:

- By 2019, for the first time in history, NATO will not account for the majority of worldwide defence expenditure, having accounted for almost two-thirds of global spending as recently as 2010;

- By 2020, defence spending in Asia Pacific will exceed that of the US, if sequestration continues; at present the US outspends the region by USD170 billion;

- Rapid growth in the Middle East and North Africa will come to an end as oil revenues slump;

- Despite a two percent cut in 2014, the UK resumed its position as the third highest spender on defence above Japan, Russia, and France, due to Russian currency depreciation;

- Russian defence spending is forecast to reach its peak of USD62.6 billion in 2015;

- India is forecast to become the third largest defence market by 2020.

NATO number two by 2019

NATO expenditure is expected to fall in real terms from USD869.6 billion in 2014 to USD837.9 billion by 2020. By the end of the decade, NATO spending will decline from 54.4 percent of total spend to 48.5 percent.

“By 2019 the alliance will fail to account for the majority of worldwide defence expenditure for the first time in its history having accounted for almost two-thirds of global spending as recently as 2010,” said Fenella McGerty, senior defence budgets analyst at IHS Aerospace & Defence.

“Spending in Asia Pacific meanwhile is expected to grow to USD547.1 billion by 2020, over 30 percent of the global total,” said Craig Caffrey, senior defence budgets analyst at IHS Aerospace & Defence.

Asia Pacific drives future defence sector growth

Despite not being immune to the challenges in the global economy, growth in Asian defence expenditure is expected to accelerate from 3.3 percent in 2014 to 4.8 percent in 2015. Unlike in the Middle East and North Africa, falling oil prices are expected to have a net positive effect upon economic growth in China, India and Indonesia and will aid government finances.

“By 2020, the centre of gravity of the global defence spending landscape is expected to have continued its gradual shift away from the developed economies of Western Europe and North America and towards emerging markets, particularly in Asia,” Caffrey said. “In terms of overall growth in each region between 2015 and 2020, Asia Pacific is expected to solidify its role as the key driver of growth in the defence sector.”

By 2020, defence spending in Asia Pacific will exceed that of the US if sequestration continues; at present the US outspends Asia Pacific by USD170 billion.

Since Asia Pacific is now home to over a quarter of all global defence expenditure, growth in this region is expected to drive the global recovery in military spending.

Middle East and North Africa slump

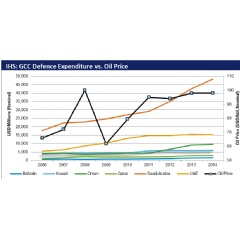

Expenditure in the Middle East and North Africa has expanded rapidly over the past three years, led by huge budget increases in Algeria, Oman and Saudi Arabia.

“Between 2011 and 2014, regional spending increased by 29.6 percent in real terms from USD108.5 billion to USD140.2 billion, the largest proportional increase in defence spending of any region over the period,” Caffrey said.

Given the generally higher levels of dependency of the Gulf States on energy revenues, sustained increases in defence expenditure among the GCC states have tended to follow increases in oil prices. Declining returns from the oil sector will temper short term growth in the region. With oil prices dipping below USD65 a barrel, the short term fiscal outlook for producers in the Middle East and North Africa region has become significantly more constrained.

US: investment at its lowest in a decade

IHS expects a further USD7.5 billion degradation in the defence budget request through Fiscal Year (FY) 2019, as the US reduces its troop strength in Afghanistan and faces continuing pressure from sequester reductions likely to restart in FY16.

“Investment, procurement plus research and development in FY14 will be the lowest value in a decade,” said Guy Eastman, senior defence budgets analyst at IHS Aerospace & Defence.

However, FY15 investment is projected to be even lower at USD158.4 billion. “We expect a decent increase in investment starting in FY16, yet dependent on a potential sequester becoming reality once again,” Eastman said.

UK reclaims third place as rouble falls

Whether the UK or Russian defence budget is bigger depends upon exchange rate fluctuations of the ruble against the dollar in a given year. “The UK defence budget was cut by two percent in 2014 but, but as the ruble depreciated the UK resumed its position as the world’s third largest defence budget, up from fourth place in 2013,” McGerty said.

Russia defence budget to peak in 2015

The Russian defence budget increased by 17.8 percent in 2014, the fourth consecutive year of double digit growth, to reach RUB2.5 trillion (USD54.4 billion).

Russian defence spending is forecast to reach its peak of RUB3 trillion (USD62.6 billion) in 2015.The economic repercussions of Moscow’s actions in Ukraine, combined with a precipitous fall in the price of oil over the course of 2014 look set to derail spending plans for 2016 and 2017.

About the IHS Jane’s Annual Defence Budgets Report

To learn more about IHS Jane’s Defence Budgets visit www.ihs.com/jdb

The IHS Jane’s Annual Defence Budgets Report is the world’s most comprehensive, forward-looking study of government’s defence budgets. Tracking 98 percent of the global defence expenditure from 91 of the world’s largest defence budgets, data is compiled from IHS Jane’s Defence Budgets online solution platform. It includes five-year forecasts, historical data, budget charting, trend evaluation and in-depth analysis by country. In this study, values are based on constant 2014 US dollars.

The following Top 20 Ranking is taken from the IHS Jane’s Annual Defence Budgets Report.

Country 2014 Defence Budget (USD mn)

1 United States 586,920

2 China 176,252

3 United Kingdom 58,072

4 Japan 54,614

5 Russian Federation 54,404

6 France 52,649

7 Saudi Arabia 48,457

8 India 47,783

9 Germany 42,971

10 Brazil 34,434

11 Australia 32,951

12 Korea, South 32,601

13 Italy 26,939

14 Canada 18,028

15 Turkey 17,202

16 United Arab Emirates 15,305

17 Taiwan 14,660

18 Israel 13,202

19 Spain 12,825

20 Algeria 12,026

###

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of insight, analytics and expertise in critical areas that shape today’s business landscape. Businesses and governments in more than 150 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners. © 2014 IHS Inc. All rights reserved.

( Press Release Image: https://photos.webwire.com/prmedia/7/194086/194086-1.png )

WebWireID194086

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.