Exane BNP Paribas and BNP Paribas CIB conducted a study in April 2019 of 145 European companies on share buybacks

Share buyback transactions have developed significantly in recent years. In the US, S&P 500 companies bought more than 1 trillion dollars of their own shares in 2018, according to TrimTabs RI, beating the 2017 record. The same trend can be found in Europe, as demonstrated by the April 2019 study carried out jointly by Exane BNP Paribas and BNP Paribas CIB with a panel of 145 companies. Of the companies surveyed*, nearly 50% have an active share buyback programme while 10% are considering implementing one as part of their internal debate on how to optimise the return of value to their shareholders.

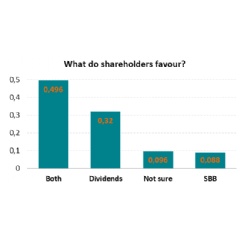

Share buyback: a preferred way to return value to shareholders

50% of companies surveyed are opting for mixed solutions that incorporate share buybacks and dividends in order to return value to shareholders. The majority of them also note the surge in queries related to share buyback policies from investors, particularly in North America.

The investors who support share buybacks the most are Hedge Funds (74%), Mutual Funds (69%), followed by Pension Funds and Wealth Funds. In addition, share buybacks are an almost systematic demand from activist investors.

Organisation and solutions

Share buybacks are mainly managed by treasurers (85%) and Chief Financial Officers (75%). The heads of investor relations (51%) and corporate finance (37%) are also frequently involved.

According to the companies surveyed, the most important factor in the operation, apart from regulation, is the price.

In seeking the best price, companies tend to favour buyback structure types such as “discount on VWAP periods”, in which the bank or broker guarantees the company a discount on the weighted average share price over an agreed upon period of time: this structure is preferred by nearly 80% of respondents.

‘Share buyback operations are significant and are growing, with half of the companies surveyed already having an existing programme, and an additional 10% considering one. Very active in this activity, BNP Paribas, together with the Exane BNP Paribas teams, have developed a wide range of share buyback solutions in order to meet the growing expectations, geographic requirements and demands of our clients in Europe’, says Xavier Mengin, Global Head of Strategic Equity at BNP Paribas.

‘The excellence of Exane BNP Paribas’ Cash Equity platform, ranked No. 1 in The Trade 2019 survey, benefits its investor and corporate clients’, explained Emmanuel Sasson, Head of Corporate Broking at Exane BNP Paribas.

*Additional information

The 145 companies surveyed in this study are mainly large cap companies. Together, they cover all business sectors, in France, the United Kingdom, Germany, the Netherlands, Spain, Italy, Switzerland and other European countries.

Exane BNP Paribas is a leader in European equities. We provide our clients with a high-quality execution platform with full electronic capability. Our research product is known for its independence, depth and quality, and is reinforced by highly-experienced, top-ranked sales and specialist sales teams, as well as a dedicated corporate access service.

( Press Release Image: https://photos.webwire.com/prmedia/6/242138/242138-1.png )

WebWireID242138

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.