Shell invests in PowerNap subsea tie-back in Gulf of Mexico

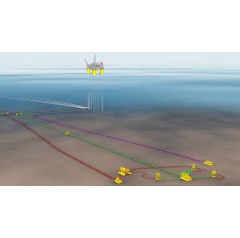

Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, has taken the final investment decision (FID) for the PowerNap deep-water project in the US Gulf of Mexico. PowerNap is a subsea tie-back to the Shell-operated Olympus production hub.

The project is expected to start production in late 2021 and produce up to 35,000 barrels of oil equivalent per day (boe/d) at peak rates. It is anticipated to have a forward-looking break-even price of less than $35 per barrel and is currently estimated to contain more than 85 million barrels of oil equivalent recoverable resources.

“PowerNap further strengthens Shell’s leading position in the Gulf of Mexico,” said Wael Sawan, Shell’s Upstream Director. “It demonstrates the depth of our portfolio of Deep Water growth options, and our ability to fully leverage our existing infrastructure to unlock value,” he added.

Shell has a leading deep-water portfolio with an exciting development funnel and strong exploration acreage in the US Gulf of Mexico, Brazil, Nigeria and Malaysia heartlands, as well as in emerging offshore basins such as Mexico, Mauritania and the Western Black Sea. Shell currently is the largest leaseholder and one of the leading offshore producers of oil and natural gas in the US Gulf of Mexico.

-----

- Shell discovered PowerNap in 2014. 100% developed by Shell, it is located in the south-central Mississippi Canyon area approximately 240 kilometres (150 miles) from New Orleans in about 1,280 metres (4,200 feet) of water.

- The Shell-operated (71.5%) Olympus production hub is co-owned by BP Exploration and Production Inc. (28.5%). Production at Olympus began in 2014.

- PowerNap production will be transported to market on the Mars pipeline, which is operated by Shell Pipeline Company LP and co-owned by Shell Midstream Partners, L.P. (71.5%) and BP Midstream Partners LP (28.5%).

- Shell continues to be a leading operator in the US Gulf of Mexico, operating nine production hubs and a network of subsea infrastructure.

- The forward-looking break-even price presented above is calculated on all forward-looking costs associated from FID. Accordingly, this typically excludes exploration and appraisal costs, lease bonuses, exploration seismic and exploration team overhead costs. It is also calculated based on our estimate of resource volumes that are currently classified as 2p and 2c under the Society of Petroleum Engineers’ Resource Classification System. As this project is expected to be multi-decade producing, the less than $35 per barrel projection will not be reflected either in earnings or cash flow in the next five years. The currently estimated peak production and 2p/2c recoverable resources presented above are 100% total gross figures.

Cautionary Note

The companies in which Royal Dutch Shell plc directly and indirectly owns investments are separate legal entities. In this release “Shell”, “Shell group” and “Royal Dutch Shell” are sometimes used for convenience where references are made to Royal Dutch Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Royal Dutch Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this release refer to entities over which Royal Dutch Shell plc either directly or indirectly has control. Entities and unincorporated arrangements over which Shell has joint control are generally referred to as “joint ventures” and “joint operations”, respectively. Entities over which Shell has significant influence but neither control nor joint control are referred to as “associates”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

This release contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Royal Dutch Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Royal Dutch Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”, “ambition’, ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Royal Dutch Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this release, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; and (m) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this release are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Royal Dutch Shell’s Form 20-F for the year ended December 31, 2018 (available at www.shell.com/investor and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this release and should be considered by the reader. Each forward-looking statement speaks only as of the date of this release, August 1, 2019. Neither Royal Dutch Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this release.

We may have used certain terms, such as resources, in this release that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.

( Press Release Image: https://photos.webwire.com/prmedia/6/244661/244661-1.jpg )

WebWireID244661

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.