2019 China New-Vehicle Intender Study (NVIS)

* Customers in China Expect More In-Vehicle Technologies, but Aren’t Willing to Pay More, J.D. Power Finds

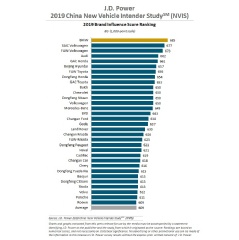

* BMW, SAIC Volkswagen and FAW-Volkswagen are Highest-Ranked Brands in Brand Influence

Both the cost that intended new-vehicle buyers in China tend to pay for a new car and their willingness to replace their current car with a new one decreased; however, offering multiple in-vehicle technologies are likely to increase their purchase intentions, according to the J.D. Power 2019 China New-Vehicle Intender StudySM (NVIS), released today.

The study, now in its 11th year, examines consumer perceptions of vehicles and the purchase behaviors of those who intend to purchase a new vehicle within the next 12 months. The study also measures purchase decision factors when considering a vehicle for purchase, brand recognition, favorability and impression, as well as consumer interest in new technologies.

The study shows that the average price of a considered car by intended buyers has dropped by 12% to RMB 215K (USD 31.3K), from RMB 244K (USD 35.5K) in 2018. Moreover, the willingness of replacing a current car with a new car has decreased to 20% in 2019 from 37% in 2016.

“Consumers in China are mostly motivated by demands such as making a better life or enjoying driving, which result in owning a new car being an option rather than a must,” said Edward Wang, Research Director at J.D. Power China. “Together, the tightened purchase budget and the declined repurchase willingness make it hard to be optimistic about the new car market in 2019.”

The study also finds that when considering a new car, the importance of variety of in-vehicle technology has risen to 7% in 2019 from 3% in 2018, with its importance ranking moving from 11th to 6th, compared with 2018. Intended buyers demonstrate strong demands for interior multi-media features, with built-in navigation system (68%), built-in Bluetooth (58%) and built-in Internet connection/Wi-Fi (56%) being the top three features they expect.

“In the absence of the momentum for new car sales in China, providing customers with diversified and differentiated in-vehicle technologies is likely to increase their purchase intentions,” Edward said. “Customers’ expectations on in-vehicle technologies significantly increase when purchase budget exceeds RMB 100K (USD 14.5K), which is difficult to cover. Therefore, it is important for manufacturers to carefully evaluate the specific needs of customers and provide flexible features options. This will help manufactures to win in the current challenging market.”

Following are additional findings of the 2019 study:

- Consumers are wary of buying cars online: Although 70% of respondents say they “definitely will” or “probably will” buy a new car on the OEM official website or a third-party trading platform/APP, only 7% say they will pay the full car price online.

- Brand influence of Chinese domestic New Energy Vehicle (NEV) brands is weaker: According to the Brand Influence Score (BIS), a combination of measurements of perceived brand awareness, brand familiarity and brand favorability, the brand image of domestic NEV brands is vague and lags behind others in BIS, although they have preliminarily established an intelligent and avant-garde brand image.

- Battery technology and vehicle reliability become big concerns to NEV intenders: Concerns about drive range of NEVs has significantly reduced compared with last year (-9% to 33% from 42% in 2018), while concerns about battery technology and vehicle reliability have increased by 9% and 8% to 42% and 30% respectively, compared with 2018.

The study also includes a brand influence score (BIS) which measures familiarity and favorability of automotive brands among intended new-vehicle buyers in China. BMW achieves a BIS of 685 (on a 1,000-point scale), followed by SAIC Volkswagen (677) and FAW-Volkswagen (673).

The 2019 China New-Vehicle Intender Study is based on responses from 11,977 new-vehicle intenders. The study includes 67 brands and was conducted online in March-April 2019.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. Those capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe. For more information, please visit china.jdpower.com or stay connected with us on J.D. Power WeChat and Weibo.

( Press Release Image: https://photos.webwire.com/prmedia/5/243343/243343-1.jpg )

WebWireID243343

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.