Can the Swiss economy soon tolerate EUR/CHF parity?

Credit Suisse publishes its "Monitor Switzerland" for Q2 2019

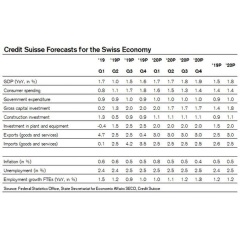

Credit Suisse economists are leaving their forecast for Swiss economic growth in 2019 at 1.5%. Private consumption remains comparatively solid, partly because immigration is picking up again slightly. After a good start to the year, industry will nevertheless be faced with weak demand. Published today, the latest issue of “Monitor Switzerland” also shows how industry will need to cope with a trend toward EUR/CHF parity in the longer term. The ability of the individual sectors to deal with such a situation varies. That is a key reason why the Swiss National Bank is likely to resist an appreciating CHF in the near term. Although the Credit Suisse economists see a rate cut as fairly unlikely, they do expect selective intervention in the foreign exchange market.

Although the Swiss economy enjoyed a strong start to 2019, the Credit Suisse economists are less sanguine about the outlook. Growth in exports, for example, is likely to slow as the year progresses. As subdued export demand is generally accompanied by a sluggish propensity to invest, no additional growth impetus is expected from capital spending on machinery and equipment either. At the same time, rising vacancy rates in the rental apartments market are likely to dampen the growth in construction investment. Private consumption still looks to be in a comparatively comfortable position: A persistently healthy labor market, coupled with slightly higher levels of immigration, will continue to provide support for the foreseeable future. However, the dynamic growth in consumer spending will not be enough to offset fading momentum in the export industry; consequently, economic growth is set to slow in overall terms based on Credit Suisse forecasts.

No return to positive interest rates any time soon

In an uncertain global environment, and in view of indications from both the US Fed and the European Central Bank that monetary policy will continue to be loosened rather than tightened, it seems increasingly unlikely that the Swiss National Bank (SNB) will hike interest rates at any point in the foreseeable future. However, another rate cut seems equally unlikely – despite the fact that the Credit Suisse economists believe there is still some leeway here. A more likely scenario is selective intervention on the foreign exchange market in order to dampen any upward pressure on the Swiss franc. The SNB will be unwilling to expose Swiss exporters to another exchange-rate shock for now.

Myth of the perpetually overvalued Swiss franc

In the study’s Focus article, the Credit Suisse economists show that a further appreciation of the Swiss franc against the euro is nevertheless highly probable longer-term. Credit Suisse exchange-rate models currently show only a slight overvaluation against the euro; however, the economic drivers of lower inflation and a high balance of trade surplus point to a continuation of the currency’s long-term appreciation. Yet according to the Credit Suisse analysis, the Swiss franc’s overvaluation against the euro is actually a relatively new phenomenon. The bank’s calculations show that the EUR/CHF exchange rate should actually have been significantly higher between 2003 and 2010 on the basis of fair value at the time. The Swiss franc was therefore undervalued against the euro for many years – a period in which the Swiss economy enjoyed incredibly cheap currency conditions. The likelihood is that some of the capacity recently removed due to the pressure of an overvalued Swiss franc was built up during those benign years. According to the Credit Suisse economists, it was the abrupt shift from an undervalued currency to an overvalued one that put too great a strain on the economy’s ability to adapt, rather than the moderate overvaluation itself.

Majority of sectors view the Swiss franc as still overvalued

From a macroeconomic point of view, it is likely that even if the Swiss franc achieves parity with the euro, in around five years’ time it will no longer be considered as significantly overvalued. However, the sector-specific analysis by the Credit Suisse economists shows that the majority of sectors view the current exchange rate as clearly too high. The degree of adjustment to a persistently weak euro varies strongly from industry to industry. The analysis suggests that the pharmaceutical industry is best-placed overall: Its sector-specific EUR/CHF fair value is no longer overvalued, its dependency on the euro zone is minimal, and it has strong pricing power. The watch industry is in a similarly advantageous situation. According to the Credit Suisse economists, Switzerland’s machinery and equipment industry still faces overvaluation; however, it does seem to have comparatively high pricing power and in global terms is comparatively well diversified. The electrical engineering sector starts from a similar – if not quite as positive – position.

Further outsourcing expected in “traditional” industries

The chemicals and metal industries have almost recovered their price competitiveness, according to the Credit Suisse analysis. Even so, both have somewhat lower pricing power than the above-mentioned sectors. In addition, the metals industry is closely centered on Europe. Parts of the food, textiles, and vehicles industries, plus the paper and plastics sectors in general, face a more difficult situation. This is because they have minimal pricing power, a high degree of overvaluation, or are dominated by the euro zone (or a combination of these factors). In these industries, the Credit Suisse economists therefore expect a further outsourcing of activities abroad. This will be the case unless the industries can offset the impact of price competition by developing less price-sensitive niche products and thus improving their market position.

“Monitor Switzerland” is published quarterly, and is available online in German and French at:

credit-suisse.com/monitorswitzerland

The next issue will be published on September 17, 2019.

Credit Suisse AG

Credit Suisse AG is one of the world’s leading financial services providers and is part of the Credit Suisse group of companies (referred to here as ’Credit Suisse’). Our strategy builds on Credit Suisse’s core strengths: its position as a leading wealth manager, its specialist investment banking capabilities and its strong presence in our home market of Switzerland. We seek to follow a balanced approach to wealth management, aiming to capitalize on both the large pool of wealth within mature markets as well as the significant growth in wealth in Asia Pacific and other emerging markets, while also serving key developed markets with an emphasis on Switzerland. Credit Suisse employs approximately 46‘200 people. The registered shares (CSGN) of Credit Suisse AG’s parent company, Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York. Further information about Credit Suisse can be found at www.credit-suisse.com.

Disclaimer

This document was produced by and the opinions expressed are those of Credit Suisse as of the date of writing and are subject to change. It has been prepared solely for information purposes and for the use of the recipient. It does not constitute an offer or an invitation by or on behalf of Credit Suisse to any person to buy or sell any security. Any reference to past performance is not necessarily a guide to the future. The information and analysis contained in this publication have been compiled or arrived at from sources believed to be reliable but Credit Suisse does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof.

( Press Release Image: https://photos.webwire.com/prmedia/6/242437/242437-1.jpg )

WebWireID242437

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.