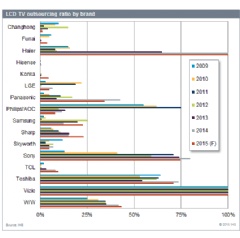

Leading TV Brands More Reliant on Chinese Manufacturers in 2015, IHS Says

TV manufacturing outsourcing is forecast to reach a record high of 43 percent this year

TVs made by outsourcing specialists are expected to reach an industry record of 43 percent of LCD TVs shipped globally in 2015, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight. Outsourcing manufacturing has become one of the most important business strategies for TV brands, because it can improve supply-chain cost management and increase time-to-market business opportunities.

“A major driving force behind TV outsourcing is the constraint on TV panel supply, which can cause TV brands to increase their outsourcing from vendors who are able to secure a stable and competitive panel supply,” said Deborah Yang, director of display supply-chain analysis at IHS.

LCD TV panel supply was tight in 2014, particularly for the mainstream 32-inch size, so top TV brands used TV subcontract manufacturers in China. BOE and TCL were chosen for their semi-set outsourcing and original equipment manufacturing (OEM) TV production in the first quarter (Q1) of 2015. “Both BOE and TCL have direct access to 32-inch panel supplies from their captive panel makers, which is welcome news to Chinese TV makers looking to not only grow their branded TV businesses, but also to expand their businesses with TV brands globally,” Yang said.

According to the IHS Quarterly LCD TV Value Chain & Insight Report, leading Korean TV brands plan to maintain or lower their in-house backlight-module-system (BMS) capacity and production in overseas factories, as they use their captive capacity for more mainstream products and for the production of 4K resolution, curved screens, wide-color gamut (WCG), and other high-end product features.

Most TV brands selling low-cost entry-level products plan to increase their outsourcing from vendors in Taiwan and China,’ Yang said. “Japanese TV brand business models are more complex, as they also license their brands to subcontract manufacturers. It is likely that other struggling TV brands may copy Japanese business models, in order to survive in the market.”

Since late in the third quarter (Q3) of 2014, leading global TV brands have been lowering TV retail prices to aggressively pursue market share. They are therefore wielding greater influence over the panel supply, causing panel makers to list them as first-priority customers.

Samsung, LGE, Sony, and other leading TV brands with a captive panel supply and a competitively strong panel-supply base continuously gained market share last year. While concerns have been raised about another panel shortage in 2015, top TV brands have been able to secure the TV panel allocations they need, in order to meet their ambitious annual targets. “This situation has put pressure on profit margins throughout the TV supply chain, which will also stimulate the LCD TV subcontract manufacturing business,” Yang said.

The IHS Quarterly LCD TV Value Chain & Insight Report maps the relationships between LCD TV brands, OEMs and panel suppliers with actual shipment and business plans as well as LCD TV supply chain intelligence information. For information about purchasing this report, contact the sales department at IHS in the Americas at (844) 301-7334 or AmericasLeads@ihs.com; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or technology_emea@ihs.com; or Asia-Pacific (APAC) at +604 291 3600 or technology_APAC@ihs.com.

About IHS (www.ihs.com)

IHS (NYSE: IHS) is the leading source of insight, analytics and expertise in critical areas that shape today’s business landscape. Businesses and governments in more than 150 countries around the globe rely on the comprehensive content, expert independent analysis and flexible delivery methods of IHS to make high-impact decisions and develop strategies with speed and confidence. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

( Press Release Image: https://photos.webwire.com/prmedia/2/198467/198467-1.png )

WebWireID198467

This news content was configured by WebWire editorial staff. Linking is permitted.

News Release Distribution and Press Release Distribution Services Provided by WebWire.